Business Credit Cards

Rewards, cash back & community banking since 1921

Your Community Banking Partner

Since 1921, we’ve been helping businesses thrive with personalized banking solutions. Choose Cape & Coast Bank business credit cards that deliver real value—whether you prefer unlimited cash back or flexible reward points*2 for your company.

Why Choose Cape & Coast Bank Business Credit Cards?

- Over 100 years of community banking experience helping businesses succeed

- Email and Text Fraud Alerts

- Fraud Monitoring and Zero Fraud Liability

- Transaction Reporting

- Travel Accident Insurance1

- No annual fees*

- Ccompetitive rewards programs

- Unlimited employee cards with spending controls at no extra cost

Community Banking Advantages

- Personal relationships where we know your business and provide custom solutions

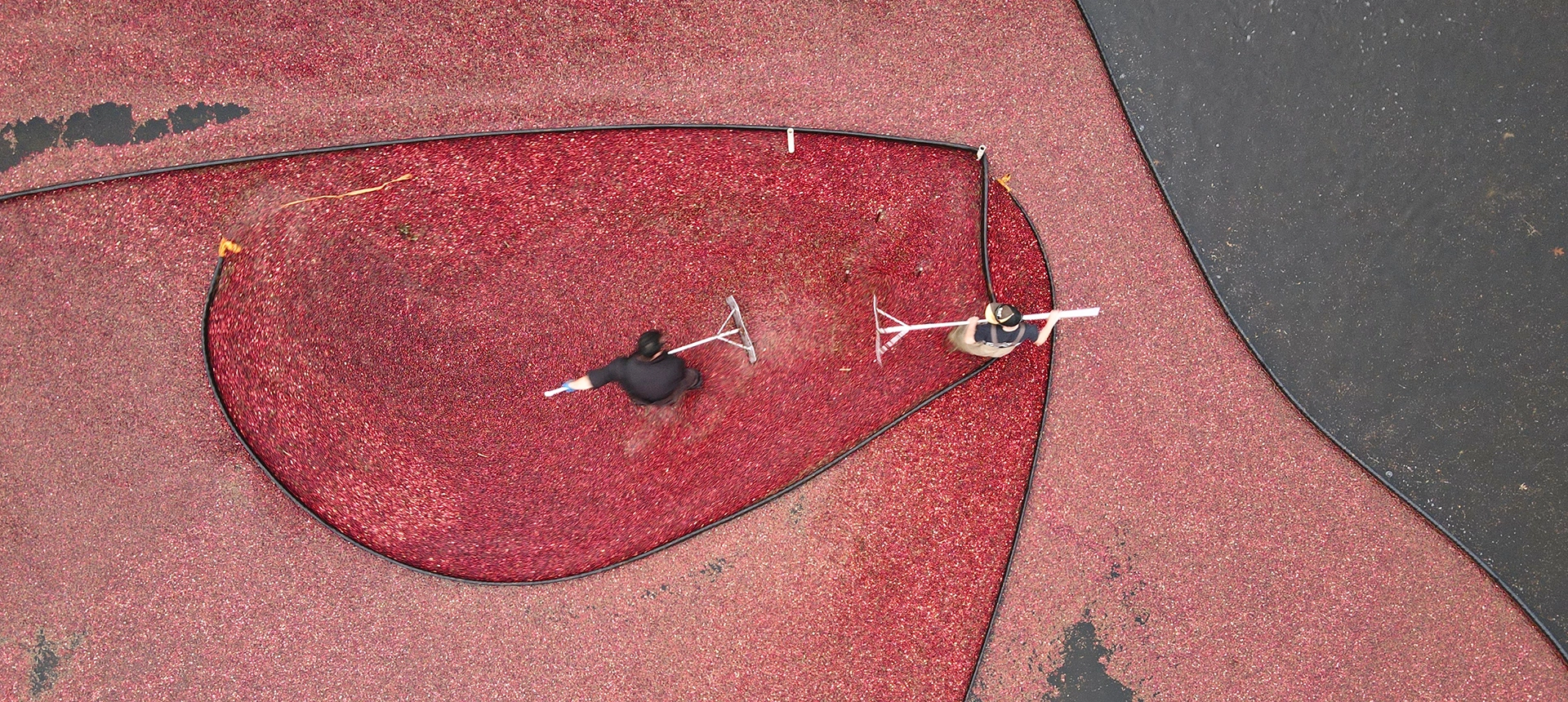

- Local expertise in seasonal businesses and local economy challenges

- Responsive service from people who understand your market needs

- Investment in our communities through charitable giving and local job support

Choose Your Business Credit Card

Both cards offer the security and convenience of Visa with the personal service of Cape & Coast Bank. Select the option that best matches your business spending preferences.

Business Rewards Credit Card

Earn unlimited reward points. Earn one point per dollar on net purchases and redeem for merchandise, rental cars, travel and more.2

- Earn one point per dollar on net purchases

- Visit cRewardsCard.com for redemption details

- Travel accident insurance coverage1

- Zero liability fraud protection

- Visa acceptance worldwide

Business Cash Rewards Credit Card

Earn 1% cash back on all net purchases. Cash rewards never expire, giving you flexibility in how you use your earnings.2

- Earn 1% cash back on all net purchases

- Cash rewards never expire

- Zero liability fraud protection

- Visa acceptance worldwide

- Keep business and personal spending separate

Business Edition Credit Card

Designed for businesses seeking low-cost financing with competitive rates and no penalty APR for reliable payment flexibility.

- No penalty APR and low interest rates

- Zero liability fraud protection

- Visa acceptance worldwide

- Keep business and personal spending separate

Company Rewards Charge Card

Perfect for businesses preferring full monthly payment with no annual fee. Enjoy charge card convenience without ongoing debt.

- No annual fee*

- Pay-in-full account

- Zero liability fraud protection

- Visa acceptance worldwide

- Unlimited rewards

- Manage spending with transaction reporting

- No cost employee cards

- Keep business and personal spending separate

Ready to Separate Business & Personal?

Join hundreds of businesses who trust Cape & Coast Bank for their credit card needs. Apply online in minutes or visit any of our convenient locations throughout the area.

Business Banking Made Simple

Application Process Made Easy

Getting your Cape & Coast Bank business credit card is simple. Our streamlined process gets you approved and spending quickly so you can focus on running your business.

Business Credit Card Questions

Get answers to common questions about Cape & Coast Bank business credit cards, and features for businesses.

Can I add employee cards to my account?

Yes! Add unlimited employee cards at no extra cost. Set individual spending limits and track each cardholder’s purchases.

What fraud protection do you offer?

We provide zero liability fraud protection and 24/7 monitoring. You won’t pay for unauthorized purchases on your account.

Are there annual fees on these cards?

No! Both our Business Rewards and Business Cash Rewards cards have no annual fees**. No hidden costs or surprise charges.

Start Building Business Credit Today

Join the businesses that trust Cape & Coast Bank for smart financial solutions. Apply for your business credit card online or visit any of our convenient locations throughout the region.

*See the card application’s Important Disclosures for current terms, rates and fees.

All cards are issued by TCM Bank, N.A. and subject to credit approval.

Coverage applies when the entire cost of the fare (less redeemable certificates, vouchers, or coupons) has been charged to the card. Your account must be in good standing. Restrictions to coverage may apply.

Visa is a registered trademark of Visa International Service Association and is used by the issuer pursuant to license from Visa U.S.A. Inc.